Welcome to the Dinar Daily NEWS Blog. For regular Dinar News Updates, Dinar to USD listings, Iraqi Dinar info and Dinar info – THAT MATTERS!! This is a good place to start for your Daily Dinar Recap – if you are a Dinar vet or just looking for the current Dinar Value – Welcome.

Word for the day…

Mrs. BGG

Iraqi Dinar/Dollar auction (most recent listing) 06-12-16

Currency Auctions Announcement No. 3218

This daily currency auction was held in the Central Bank of Iraq on the 06-12-2016

The results were as follows:

| DETAILS | NOTES |

| Number of banks | 32 |

| Number of remittance companies | 18 |

| Auction price selling dinar / US$ | 1182 |

| Auction price buying dinar / US$ | —– |

| Amount sold at auction price (US$) | 144,146,155 |

| Amount purchased at Auction price (US$) | —– |

| Total offers for buying (US$) | 144,146,155 |

| Total offers for selling (US$) | —– |

More: http://dinarupdates.com/observer/

______________________________________________________________

Life-the way it really is – is a battle not between good and bad, but between bad and worse. – Joseph Brodsky

*** Current News ***

Follow us on twitter @DinarUpdates !!

Don’t Miss “NEWS TIME” w/Millionday in DU CHAT ROOM – Sunday 7:30pm EST

Don’t Miss “NEWS TIME” w/Millionday in DU CHAT ROOM – Sunday 7:30pm EST

www.DinarUpdates.com – save as favorite!!

The Exchange Rate of Foreign Currency in Economic Feasibility Studies

Below are the central controls related to the exchange rate of the foreign currency to convert the project inputs and outputs from foreign currency to its equivalent in the local currency, and that is by calculating the net discounted present value standard and the internal return on investments in economic analysis that governs investment projects that costs excess one million dinars.

Estimate the shadow price of foreign currency:

1. It is necessary to put central controls to amend the official exchange rate * to reflect the shadow price of the foreign currency, and that is considered one of the necessary requirements to implement the net discounted present value standard and the internal return rate on investment in the economic calculation stated in the instructions, paragraph nine.

The central controls for adjusting market prices distinguished a group of outputs and inputs traded internationally, where the projects production or usage of them is reflected on the abundance of foreign currency in the economy and thus project outputs or inputs used of such are considered purely foreign currency outputs or inputs.What is meant by exchange rate: the number of units of foreign currency, expressed in dollar per one dinar.In particular the following outputs and inputs of foreign currency were distinguished:

- Export-outputs.

- Outputs marketed locally that substitute imports.

- Imported inputs.

- Inputs produced locally that usually go to exports.

- Foreign labor.

According to the pricing rules the value of the output and input (traded) is calculated using export prices (FOB) and import prices (CIF), according to what is listed in the pricing rules.

In other words the pricing rules calculate what the project produces from foreign currency (quantity of exports multiplied by the export price (FOB) in foreign currency or the quantity of substitute imports multiplied by the import price (CIF) in foreign currency, as well as what the project uses from foreign currency and imported inputs multiplied by the import price (CIF) in foreign currency …. etc.).

In a later step, project outputs and inputs must be converted from the foreign currency to its equivalent in local currency (dinars) by using a specific exchange rate for the foreign currency.

2. Justifications for exchange-rate adjustment: there are a number of important and powerful arguments which support the view that the official exchange rate reduces the real value of foreign currency for purposes of calculating the economic national profitability for investment projects and hence for the purposes of investment planning. It is demonstrated in this context to call for assessing the dinar for less than (3.208) dollar (official exchange rate) when assessing project outputs and inputs of traded goods of exports, substitute imports and imports… etc.The justifications to call for the use of an exchange rate that is lower than the official exchange rate are:

- The use of an exchange rate that is lower than the official rate is the appropriate action at the investment planning level to translate the country’s economic strategy aiming at stimulating central investments in the sectors that encourage the development of non-oil exports, as well as sectors that encourage the expansion of domestic production base in order to reduce imports and compensate it with local commodities. This helps to reduce reliance on foreign exchange earnings from crude oil exports and increases the share of non-oil sectors in the local production.

- The application of the amended exchange rate on project imported inputs will assist in directing investments away from aggregated sectors dependent on imported inputs and the preference of those sectors that rely on locally produced inputs.

- The use of the amended exchange rate helps to correct the balance in favor of the traded goods sectors compared to non-traded goods.

- The real exchange rate has declined rapidly since the early seventies, through rapid rise of the level of prices and local costs which led by the steadiness of the official exchange rate to change in prices and actual local rate costs that gave an advantage for imported goods at the expense of locally produced goods, meaning that it led to deterioration of the competitiveness of alternative replacement goods and export commodities.

- This action shows that the official exchange rate overestimates the value of the dinar, compared to the foreign currency and from the promoting goods substituting imports and export commodities point of view of.And in support to this view is the state’s utilization and in a broad approach to the customs and quantitative protection policies especially for consumer goods, as well as export subsidies that exports have through an amended export exchange rate.

3. Estimate the amended exchange rate of the Iraqi dinar to be used in technical and economical feasibility studies and for (1.134) dollar per dinar. This price should be approved for 3 years until re-appreciation by the competent authorities.

The Republic of Iraq – Ministry of Planning

Dinar Updates “Round Table” Call!!

“for Dinar News – that MATTERS!!”

from 6/09 – click-n-listen

Smart phone user link – Click here

SIGR Report Recap…

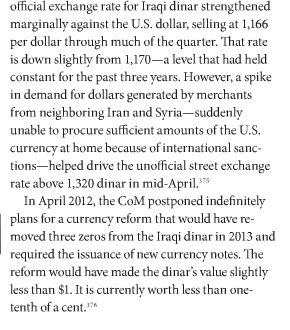

THIS REPORT WAS SENT TO CONGRESS LAST MAY (it appears to be from May of 2012). IT PLAINLY SHOWS IN THIS REPORT THEY EXPECTED THE DINAR TO REVALUE AT AROUND A DOLLAR IN 2013.

We are seeing and hearing that the inflation rate is still climbing and they are pushing to get us our money?? This screen shot is from page 84 of the massive SIGR report.

We are seeing and hearing that the inflation rate is still climbing and they are pushing to get us our money?? This screen shot is from page 84 of the massive SIGR report.

BGG ~This is a screen shot from the “Special Inspector General for Iraq Reconstruction” – May 2014, quarterly report to Congress. For members of our Government to say they have no idea what is going on here – means they haven’t read some very basic documents presented them.

__________________________________________________

I point out this is a highly speculative investment. We are, in no way, guaranteed anything. However, this SIGR report gives us some valuable insights…

1) This is information given to the US CONGRESS on a quarterly basis… I find it hard to believe such an information source would intentionally mislead Congress. They tend to frown on such behavior. Which goes directly to the validity of this adventure – against all advice from Wells Fargo or other such naysayers.

2) It points out there having been a legitimate “plan” – or time frame in motion…having been projected to be done in 2013. We are obviously in “over time” now.

3) It gives us an idea as to who is in charge…the CoM – or Council of Ministers. Who do they answer to?? Maliki (during that era – Abadi now). Period. When is he likely to push this forward?? Historically – he has been a “weak Dinar” policy advocate. However, rumor from his own inner circle admits he can’t win a third term in office without some currency reform (curiously – I did make this assertion… No currency reform = no re-election for Maliki. Guess what happened??).

I fully expect him to use every tool in his “wheel house” to win – his recent moves in Anbar and the disputed territories prove as much. Currency reform has to be a “biggie”. Though this WAS their thinking a couple of months ago – there is no promise it is still part of their political calculus. We shall see.

4) Though no guarantee of the actual future plan they wind up engaging – this report points out an increase in value that would have taken the Dinar from “one-tenth of a cent” to a value “of slightly less than $1″…

BGG – This is PUBLISHED INFO FOLKS… NOT HEARSAY…

______________________________________________________________

firefly (Dinar Guru) – Reuters Article: “Iraq plans deposit guarantee fund to curb cash stashing” Quote: “Iraq plans to set up a deposit guarantee fund to encourage Iraqis to use banking services and to develop the financial industry, the central bank said.” Reuters folks! A day after Iraq agreed to the requirements? WOW, WOW, WOW. We are looking at a position where everything is ready IMO.

Read More: http://www.dinarupdates.com/observer/

______________________________________________________________

CBI is preparing to issue a monetary metal parts

(another FLASHBACK…)

Metal coins from the category of 25 fils were in circulation until the nineties of the last century

Nora Albjara member of the committee of economy and investment in the House of Representatives revealed that the central bank completed its preparations for the issuance of metal coins of seven small groups, in conjunction with the implementation of the project to delete the three zeroes from the paper currency is currently in circulation.

She said in her statement Albjara Radio Free Iraq, “said the project will take between four and five years, and which will be the launch of the categories of small coins gradually.”

He predicted the financial expert Hilal Taan inflation rate declines, with the issuance of metal coins of small denominations in the daily financial transactions, remarkable that 3% of the value of inflation in Iraq due to the presence of large cash block.

The economic expert on behalf of Jamil Anton, noted that he may not find coins accepted by a lot of Iraqis, especially young people, due to the existence of an entire generation of Iraqis had not trading coins due to stop use since the early nineties of the twentieth century.

______________________________________________________________

BGG (Dinar Guru) – [SIGR Report…THIS REPORT WAS SENT TO CONGRESS…(it appears to be from May of 2014). IT PLAINLY SHOWS IN THIS REPORT THEY EXPECTED THE DINAR TO REVALUE AT AROUND A DOLLAR IN 2013.] This is…from the “Special Inspector General for Iraq Reconstruction” – May 2014, quarterly report to Congress. For members of our Government to say they have no idea what is going on here – means they haven’t read some very basic documents presented them. I point out this is a highly speculative investment. We are, in no way, guaranteed anything. However, this SIGR report gives us some valuable insights…It points out there having been a legitimate “plan” – or time frame in motion…having been projected to be done in 2013. We are obviously in “over time” now. Though no guarantee of the actual future plan they wind up engaging – this report points out an increase in value that would have taken the Dinar from “one-tenth of a cent” to a value “of slightly less than $1″…This is PUBLISHED INFO FOLKS…NOT HEARSAY…

Correction – as I relayed, I was unsure about several details surrounding this report and it’s actual delivery. It appears it was delivered to the US Congress in May of 2012 – having been finalized and dated Apr 30th, 2012… then referred to again in 2013 as being delivered to the US Congress “last May”. BGG

Read More: http://www.dinarupdates.com/observer/

______________________________________________________________

Coins put on the market !! (Flashback article)

Nora Albjara member of the committee of economy and investment in the House of Representatives revealed that the central bank completed its preparations for the issuance of metal coins of seven small groups, in conjunction with the implementation of the project to delete the three zeroes from the paper currency is currently in circulation.

She said in her statement Albjara “The project will take between four and five years, and which will be the launch of the categories of small coins gradually.”

He predicted the financial expert Hilal Taan inflation rate declines, with the issuance of metal coins of small denominations in the daily financial transactions, remarkable that 3% of the value of inflation in Iraq due to the presence of large cash block.

The economic expert on behalf of Jamil Anton, noted that he may not find metal coins accepted by a lot of Iraqis, especially young people, due to the existence of an entire generation of Iraqis had not trading coins due to stop use since the early nineties of the twentieth century

waradana.com

Read More: http://www.dinarupdates.com/showthread.php?18519-The-Dinar-Daily-Thursday-June-9th-2015&p=128477#post128477

______________________________________________________________

Breitling (Dinar Guru) – …If I was to go to court and someone would say…”you said it [the dinar] was going to come out at a buck seventeen.” I’d say, No, I didn’t say that…the Iraqi Parliament said that. The CBI’s made those statements…I just followed it. “Well you said that it would come out after a while after they reduced the note count to a certain number that there target rate is $3.25.” I didn’t say that…The CBI made that statement. The Ministry of Planning made that statement. Parliament made that statement to the IMF when they asked if the IMF can help them regain their economy so they can get back to their original rate. That’s how you should play the game. There is no guessing…time frame is what we’re battling against. If you guys only knew you wouldn’t worry because it’s a reality thats coming down the road. None of this is based on hype.

Read More: http://www.dinarupdates.com/observer/

______________________________________________________________

Iraqi banks association with representatives of the u.s. Treasury Iraqi banks updates

Iraqi private banks Association discussed with a team of u.s. Treasury akhralmstgdat belonging to the banking sector in Iraq, and Iraqi private banks Association representatives provided a comprehensive overview of development banking constraints and delimiters facing private banks, as referring to the Association’s efforts to develop efficient banking sector particularly in combating money laundering and financing of terrorism, through training of workers in this sector in cooperation with the Foundation for global ACAMS.

The us Treasury representatives referred to the decision of the Central Bank regarding stop 300 banking company for the purpose of subjecting them to scrutiny by the Central Bank’s standards, but it’s also the representatives of the u.s. Treasury support for CBI plans for development the sector and banking llmaaiiraldolih in combating money laundering and terrorist financing.

Developing the sector has also been addressed and should overcome to take a real course.

______________________________________________________________

For a peek at all the most up-to-date DU News – check the Iraq News Thread (in the forum)…

http://www.dinarupdates.com/forumdisplay.php?5-Current-Iraq-NEWS

______________________________________________________________

Economists Divided Over Deletion Of Zeros

By Amina al-Dahabi for Al-Monitor.

The Central Bank of Iraq (CBI) has been attempting to delete three zeros from the Iraqi currency since 2003 (the CBI has – or at least some in the CBI – the GOI, not so much, historically). This project has raised many concerns among the Iraqi public and within the business community, and Iraqi economists are divided. While some support the project and consider it a chance to decrease inflation and unemployment, others warn of economic shocks that may prevail over the Iraqi market as a result of the project’s implementation.

Following amendments made by the CBI, implementation of the project has been postponed several times. This is because of fears that are mostly related to the lack of security, the presence of a market open to foreign commodities without any restrictions, the prevalence of counterfeit money in the market and rampant corruption in the country.

The independent Iraqi News Agency (INA) quoted Abdul Hussein al-Yasiri, a member of the Iraqi parliamentary Finance Committee, as saying that 2014 will witness the deletion of zeros from the Iraqi currency. He noted that the deletion will occur in coordination with the CBI, and that as a result of the project, the number of banknotes in circulation will be reduced from 4 billion to 1 billion.

Haider al-Abadi, the head of the Iraqi parliamentary Finance Committee, told Al-Monitor that while deleting zeros from the current currency is possible, this has been postponed until after parliamentary elections. He noted that studies are being carried out to ensure that, following the currency change, counterfeiting is limited and that Iraqis don’t go back to trading in the old currency.

The step to delete zeros from the currency has been postponed several times, leading the parliamentary Economic Committee to demand that the CBI accelerate this project, as Al-Sharqiya reported. In a news conference held July 6, the Economic Committee confirmed that the deletion of zeros will lead to an increase in the value of the Iraqi dinar and will have positive repercussions, including a reduction in unemployment and poverty rates in the country.

______________________________________________________________

CURRENCY CODE SELL BUY

Dinar to USD – Dinar Value – Iraqi Dinar “IQD” listing

| CURRENCY | CODE | SELL | BUY |

| US dollar | USD | 1182.000 | 1180.000 |

| Euro | EUR | 1340.743 | 1340.072 |

| British pound | GBP | 1709.881 | 1709.026 |

| Canadian dollar | CAD | 928.442 | 927.978 |

| Swiss franc | CHF | 1229.585 | 1228.970 |

| Swedish krona | SEK | 145.705 | 145.632 |

| Norwegian krone | NOK | 144.963 | 144.891 |

| Danish krone | DKK | 180.298 | 180.208 |

| Japanese yen | JPY | 11.088 | 11.083 |

| Special Drawing Rights |

SDR | 1671.313 | 1670.477 |