Welcome to the Dinar Daily NEWS Blog. For regular Dinar News Updates, Dinar to USD listings, Iraqi Dinar info and Dinar info – THAT MATTERS!! This is a good place to start for your Daily Dinar Recap – if you are a Dinar vet or just looking for the current Dinar Value – Welcome.

Word for the day…

Mrs. BGG

Iraqi Dinar/Dollar auction (most recent listing) 09-14-16

Currency Auctions Announcement No. 3277

This daily currency auction was held in the Central Bank of Iraq on the 09-08-2016

The results were as follows:

| DETAILS | NOTES |

| Number of banks | 30 |

| Number of remittance companies | 15 |

| Auction price selling dinar / US$ | 1182 |

| Auction price buying dinar / US$ | —– |

| Amount sold at auction price (US$) | 136,428,356 |

| Amount purchased at Auction price (US$) | —– |

| Total offers for buying (US$) | 136,428,356 |

| Total offers for selling (US$) | —– |

More: http://dinarupdates.com/observer/

______________________________________________________________

In the mountains of truth, you never climb in vain. – Friedrich Nietzsche

*** Current News ***

Follow us on twitter @DinarUpdates !!

Don’t MISS – “DU NEWS TIME” w/RCookie, Mr White & Hutch in the DU CHAT ROOM – Thursday 7:30pm EST

Don’t MISS – “DU NEWS TIME” w/RCookie, Mr White & Hutch in the DU CHAT ROOM – Thursday 7:30pm EST

www.DinarUpdates.com – save as favorite

______________________________________________________________

rcookie (Dinar Guru) – Article: “Governor of the Central Bank: IMF surprised Bamtlakena reserves exceed expectations” …THE IMF…IN AUDITING CBI IS SURPRISED TO FIND $10 BILLION MORE IN RESERVES THAN PROGRAMMED FORCASTED AMOUNT...AND MORE INTERESTING… COMMENTS BY THE IMF ON THE CBI PERFORMANCE DURING THESE CHALLENGING ECONOMIC TIMES…AND ADHERENCE TO…MORE THAN 20 INITIATIVE THE IMF SPELLED OUT TO CBI…AND IN PARTICULAR…THE IMPLEMENTATION OF THE ISLAMIC FINANCIAL INSTITUTIONS ACT…WHICH WAS IN THE 2016 LOI/MEFP/TMU…

Read More: http://www.dinarupdates.com/observer/

______________________________________________________________

Dinar Updates “AFTER CALL – LIVE”!!

“Dinar Q & A Call!!”

Thursday – “After Call – LIVE”

w/RCookie, Mr White & Hutch

8:30pm EST 641-715-3640 pin#528733

from 9/9 – Smart phone user link – Click here

______________________________________________________________

Central Bank Governor: we were surprised the IMF reserves surpasses expectations

The Central Bank Governor, said the relationship, Iraq’s commitment to pledges made by the International Monetary Fund with specific timing, especially that they comport with its orientation and its goals, noting that the Fund was surprised that Iraq’s foreign currency reserves are more than expectations by about 10 billion dollars.

And concluded in Oman, Jordan, Saturday, (10th of September 2016), a new round of talks between Iraq and the International Monetary Fund on standby credit program for a loan worth 18 billion dollars, to be completed in November.

The Central Bank Governor said the Agency, Ismail “relationship Central Bank introduced during the talks detailed report all actions carried out under the agreement with him,” pointing out that “the report confirmed the Central Bank’s commitment to implementing more than 20 pledge and full proposal within a specified time schedule.

He added that such relations “obligations within the Central Bank plan, concerning various aspects, the most important action against money laundering and financing of terrorism”, noting that “the Bank integrated files provided on the regulations and controls and instructions and electronic systems that do this.”

The Governor of the Central Bank, said that “the report also included capacity-building measures both for the Central Bank or other banks, with evidence relating to inspection and control,” pointing out that “the Central Bank regarding code completion Islamic financial institutions and credit Bureau system at the national level, amendments to the law, the appointment of an external auditor to audit reserves and application and dissemination of indicators of financial stability”.

And in another axis of modern, Central Bank reserves of foreign currencies, International Monetary Fund look to him, “said the IMF report, relations between the reserve with the Central Bank more than was expected by about 10 billion dollars,” returned to “an important indicator on the performance and adequacy of Bank reserves, especially as they increase the amount of local currency, dinar, in circulation.

Iraqi Central Bank Governor said, “the International Monetary Fund evaluation proves that the Central Bank’s performance was special in light of the challenges facing Iraq and unstable circumstances economically, financially and politically and in security.”

Iraq acknowledges before mid-July 2016, approximately 634 million, representing the first installment of the IMF loan, immediately after the IMF Executive Board, authentication (the 7th of that month), the Convention on the preparation of credit with Iraq, given that the duration of the loan is five years low annual interest amounting to one and a half percent (1.5%), and the number of payments are 13 batch extending over 36 months.

The United States has been confirmed in the US, (April 20, 2016), that the Iraqi Government’s economic reforms began to show their effects by increasing non-oil imports, indicating that the Iraqi Government’s success in reducing the budget deficit means obtaining a loan from the International Monetary Fund for billions of dollars.

And had the appearance of Mohamed Saleh, confirmed in (26 January 2016), that Iraq agreed with the IMF to obtain long term loans, to implement development projects, indicating that the box under other conditions of government expenses, and certain procedures relating to economic policies, while counting the Economist that “most” of the loans is to know the amounts that will be obtained through 2016.

The IMF agreed in (13 January 2016), on financing the budget deficit through withdrawal of hard currency reserves, leading to lower those reserves of 59 billion dollars by the end of October 2015, to 43 billion by the year 2016.

______________________________________________________________

BGG (Dinar Guru) – these flashbacks (HARD NEWS) give some important context as to what we are involved in…WIth these previous statements, articles and comments giving historical context – and the current push by the IMF, WB and UN to integrate Iraq back into the international community – things are VERY exciting (to say the least). I’m not predicting anything, nor am I commenting on “rate” – per se…I’m just telling you what they (IRAQ) have been saying all along… [post 3 of 3]

Read More: http://www.dinarupdates.com/observer/

______________________________________________________________

BGG (Dinar Guru) – “The Exchange Rate of Foreign Currency in Economic Feasibility Studies” “3. Estimate the amended exchange rate of the Iraqi dinar to be used in technical and economical feasibility studies and for (1.134) dollar per dinar. This price should be approved for 3 years until re-appreciation by the competent authorities.” Ministry OF PLANNING…Iraq G-O-I !!! …REPORT WAS SENT TO CONGRESS…IT PLAINLY SHOWS IN THIS REPORT THEY EXPECTED THE DINAR TO REVALUE AT AROUND A DOLLAR IN 2013. these final thoughts from them (the final report sent to our U.S. Congress) if nothing else, adds considerable weight to our thoughts about this investment…in fact, those saying this is a “scam” – look foolish – taking these reports in context. [post 2 of 3….stay tuned]

BGG (Dinar Guru) – Flashback Article: “Minister of Finance: raise zeros from the Iraqi currency against the dollar will be supported” Quote: “…The proposal to raise three zeroes from the currency will be in accordance with the right monetary policy is not gradual, as happened in Turkey…” This article was from Feb. 2nd 2010. They’ve been telling us all along…NOT A FLOAT… Noting that the Iraqi dinar would be offset dollar or slightly more than after the application of this proposal. = about a dollar (USD) or slightly higher…THIS IS WHAT THEIR MoF said at the time. Not me…they have had some idea as to what this was going to be all along. [post 1 of 3….stay tuned]

Read More: http://www.dinarupdates.com/observer/

______________________________________________________________

Statement at the End of an IMF Mission on Iraq

End-of-Mission press releases include statements of IMF staff teams that convey preliminary findings after a visit to a country. The views expressed in this statement are those of the IMF staff and do not necessarily represent the views of the IMF’s Executive Board. Based on the preliminary findings of this mission, staff will prepare a report that, subject to management approval, will be presented to the IMF’s Executive Board for discussion and decision.

The Iraqi authorities and the staff of the International Monetary Fund (IMF) held discussions in Amman from August 28–September 10, 2016 on the first review of Iraq’s 36-month Stand-By Arrangement (SBA) approved by the IMF Executive Board on July 7, 2016. (See Press Release No. 16/321).

Mr. Christian Josz, Mission Chief for Iraq, issued the following statement:

“The Iraqi authorities and IMF staff started discussions on the first review of the SBA. These discussions will continue during the upcoming IMF and World Bank Annual Meetings from October 7–9, 2016 in Washington, DC.

“During the mission, the team met with the Minister of Finance Hoshyar Zebari, Acting Governor of the Central Bank of Iraq (CBI), Dr. Ali Allaq, the Financial Adviser to the Prime Minister Dr. Mudher Saleh, and officials from the ministries of finance, oil, planning, electricity, the CBI, and representatives from the Kurdistan Regional Government, Board of Supreme Audit, and pension commission. The team would like to thank the Iraqi authorities for their cooperation and the open and productive discussions.”

IMF Communications Department

http://www.imf.org/en/News/Articles/2016/09/12/PR16401-Iraq-Statement-at-the-End-of-an-IMF-Mission

______________________________________________________________

Be sure to join the New Dinar Updates “private” FaceBook Group…

https://www.facebook.com/groups/571383766355188/

(go here and ask to join… then add some Dinar Friends!!)

______________________________________________________________

THIS REPORT WAS SENT TO CONGRESS in MAY 2012. IT PLAINLY SHOWS IN THIS REPORT THEY EXPECTED THE DINAR TO REVALUE AT AROUND A DOLLAR IN 2013.

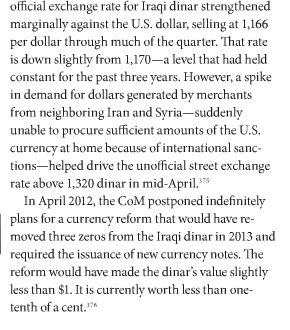

This report is from page 84 of the massive SIGR report.

BGG ~ This is a screen shot from the “Special Inspector General for Iraq Reconstruction” – Apr 2012, quarterly report to Congress. For members of our Government to say they have no idea what is going on here – means they haven’t read some very basic documents presented them.

I pointed out (last night) this is a highly speculative investment. We are, in no way, guaranteed anything. However, this SIGR report gives us some valuable insights…

1) This is information given to the US CONGRESS on a quarterly basis… I find it hard to believe such an information source would intentionally mislead Congress. They tend to frown on such behavior. Which goes directly to the validity of this adventure – against all advice from Wells Fargo or other such naysayers.

2) It points out there having been a legitimate “plan” – or time frame in motion…having been projected to be done in 2013. We are obviously in “over time” now.

3) It gives us an idea as to who is in charge…the CoM – or Council of Ministers. Who do they answer to?? Maliki. Period. When is he likely to push this forward?? Historically – he has been a “weak Dinar” policy advocate. However, rumor from his own inner circle admits he can’t win a third term in office without some currency reform.

I fully expect him to use every tool in his “wheel house” to win – his recent moves in Anbar and the disputed territories prove as much. Currency reform has to be a “biggie”. Though this WAS their thinking a couple of months ago – there is no promise it is still part of their political calculus. We shall see.

4) Though no guarantee of the actual future plan they wind up engaging – this report points out an increase in value that would have taken the Dinar from “one-tenth of a cent” to a value “of slightly less than $1″…

Read More: http://www.dinarupdates.com/

BGG ~ The above is another one of the documents I referenced on the call last nite. A review of a review – so to speak…

______________________________________________________________

For a peek at all the most up-to-date DU News – check the Iraq News Thread (in the forum)…

http://www.dinarupdates.com/forumdisplay.php?5-Current-Iraq-NEWS

______________________________________________________________

The Exchange Rate of Foreign Currency in Economic Feasibility Studies

Below are the central controls related to the exchange rate of the foreign currency to convert the project inputs and outputs from foreign currency to its equivalent in the local currency, and that is by calculating the net discounted present value standard and the internal return on investments in economic analysis that governs investment projects that costs excess one million dinars.

Estimate the shadow price of foreign currency:

1. It is necessary to put central controls to amend the official exchange rate * to reflect the shadow price of the foreign currency, and that is considered one of the necessary requirements to implement the net discounted present value standard and the internal return rate on investment in the economic calculation stated in the instructions, paragraph nine.

The central controls for adjusting market prices distinguished a group of outputs and inputs traded internationally, where the projects production or usage of them is reflected on the abundance of foreign currency in the economy and thus project outputs or inputs used of such are considered purely foreign currency outputs or inputs.

* What is meant by exchange rate: the number of units of foreign currency, expressed in dollar per one dinar. In particular the following outputs and inputs of foreign currency were distinguished:

- Export-outputs.

- Outputs marketed locally that substitute imports.

- Imported inputs.

- Inputs produced locally that usually go to exports.

- Foreign labor.

According to the pricing rules the value of the output and input (traded) is calculated using export prices (FOB) and import prices (CIF), according to what is listed in the pricing rules

In other words the pricing rules calculate what the project produces from foreign currency (quantity of exports multiplied by the export price (FOB) in foreign currency or the quantity of substitute imports multiplied by the import price (CIF) in foreign currency, as well as what the project uses from foreign currency and imported inputs multiplied by the import price (CIF) in foreign currency …. etc.).

In a later step, project outputs and inputs must be converted from the foreign currency to its equivalent in local currency (dinars) by using a specific exchange rate for the foreign currency.

2. Justifications for exchange-rate adjustment: there are a number of important and powerful arguments which support the view that the official exchange rate reduces the real value of foreign currency for purposes of calculating the economic national profitability for investment projects and hence for the purposes of investment planning. It is demonstrated in this context to call for assessing the dinar for less than (3.208) dollar (official exchange rate) when assessing project outputs and inputs of traded goods of exports, substitute imports and imports… etc.

The justifications to call for the use of an exchange rate that is lower than the official exchange rate are:

- The use of an exchange rate that is lower than the official rate is the appropriate action at the investment planning level to translate the country’s economic strategy aiming at stimulating central investments in the sectors that encourage the development of non-oil exports, as well as sectors that encourage the expansion of domestic production base in order to reduce imports and compensate it with local commodities. This helps to reduce reliance on foreign exchange earnings from crude oil exports and increases the share of non-oil sectors in the local production.

- The application of the amended exchange rate on project imported inputs will assist in directing investments away from aggregated sectors dependent on imported inputs and the preference of those sectors that rely on locally produced inputs.

- The use of the amended exchange rate helps to correct the balance in favor of the traded goods sectors compared to non-traded goods

- The real exchange rate has declined rapidly since the early seventies, through rapid rise of the level of prices and local costs which led by the steadiness of the official exchange rate to change in prices and actual local rate costs that gave an advantage for imported goods at the expense of locally produced goods, meaning that it led to deterioration of the competitiveness of alternative replacement goods and export commodities.

- This action shows that the official exchange rate overestimates the value of the dinar, compared to the foreign currency and from the promoting goods substituting imports and export commodities point of view of.

And in support to this view is the state’s utilization and in a broad approach to the customs and quantitative protection policies especially for consumer goods, as well as export subsidies that exports have through an amended export exchange rate.

3. Estimate the amended exchange rate of the Iraqi dinar to be used in technical and economical feasibility studies and for (1.134) dollar per dinar. This price should be approved for 3 years until re-appreciation by the competent authorities.

The Republic of Iraq – Ministry of Planning

Read More: http://www.dinarupdates.com/

BGG ~ This is a “Rewind” of one of the documents I referred to on the call last nite…

If you missed it – click on the “Call Banner” to the right..

______________________________________________________________

| CURRENCY | CODE | SELL | BUY |

| US dollar | USD | 1182.000 | 1180.000 |

| Euro | EUR | 1328.213 | 1327.549 |

| British pound | GBP | 1581.634 | 1580.843 |

| Canadian dollar | CAD | 916.634 | 916.176 |

| Swiss franc | CHF | 1220.570 | 1219.960 |

| Swedish krona | SEK | 139.657 | 139.587 |

| Norwegian krone | NOK | 144.460 | 144.388 |

| Danish krone | DKK | 178.426 | 178.337 |

| Japanese yen | JPY | 11.651 | 11.645 |

| Special Drawing Rights |

SDR | 1658.819 | 1657.989 |