Welcome to the Dinar Daily NEWS Blog. For regular Dinar News Updates, Dinar to USD listings, Iraqi Dinar info and Dinar info – THAT MATTERS!! This is a good place to start for your Daily Dinar Recap – if you are a Dinar vet or just looking for the current Dinar Value – Welcome.

Word for the day…

Mrs. BGG

Iraqi Dinar/Dollar auction 12-14-16 (most recent listing)

Currency Auctions Announcement No. 3338

This daily currency auction was held in the Central Bank of Iraq on the 12-14-2016

The results were as follows:

| DETAILS | NOTES |

| Number of banks | 36 |

| Number of remittance companies | 15 |

| Auction price selling dinar / US$ | 1182 |

| Auction price buying dinar / US$ | —– |

| Amount sold at auction price (US$) | 153,581,800 |

| Amount purchased at Auction price (US$) | —– |

| Total offers for buying (US$) | 153,581,800 |

| Total offers for selling (US$) | —– |

More: http://dinarupdates.com/observer/

______________________________________________________________

You can’t vote to change the laws of economics. – Will Spencer

*** Current News ***

Dinar Updates – “Round Table Call!!”

from Tues. nite – Dec 13th

w/BGG, Mr White, Loop, 1Bobby, Daytrader and MadScout!!

Click-N-Listen!!

Smart phone user link – Click here

Money laundering court is forcing community banks “contrary” to pay 245 billion dinars

Twilight New / specialized money laundering issues, the court announced that their actions have forced the eligibility banks to pay fines and benefits Tojerih owed Bzmtha as a result of violating the sale of foreign currency to take measures, and as pointed out that the total amount has been met so far reached 245 billion dinars, confirmed that it happened as a result of a complaint evoked by CBI.

He said the dead of Judge money Radi Fartusi wash in a statement quoted by the newspaper “the judiciary”, issued by the Information Center for the judiciary, he said that “reports of the Audit Court indicated the end of 2014, violations of the private banks concerning the sale and purchase of foreign currency window (the dollar).”

Fartusi He added that “This came as a result of the transfer of those banks outside Iraq sums of money through the central bank window and what not to bring them in favor of the introduction of goods in exchange for the money, or the inadequacy of the submitted documents.”

He explained that “the court has taken legal action after a complaint lodged by the Central Bank”, warning that “the violation of private banks began to pay penalties and interest The delay recorded on them from the beginning of 2012”.

He pointed out that “much of what has been done to fulfill reached 245 billion dinars,” stressing that “the last payment was in September increased by 10 billion dinars.”

The judge went on the cover of Money Laundering “The court actions taken against the private banks customers who have forged permits as a result of moving the complaints against them.”

Fartusi went out that “those banks pledged to pay penalties and interest The delay in the maximum period of the first half of next year, and that reimbursement procedures going on a month,” stressing that “the Head of the Judiciary Judge Medhat al-Mahmoud confirms to pursue all the money laundering files in order to be resolved as soon as according to the procedures of the law, and recommends overcoming all obstacles to our work in the court. ”

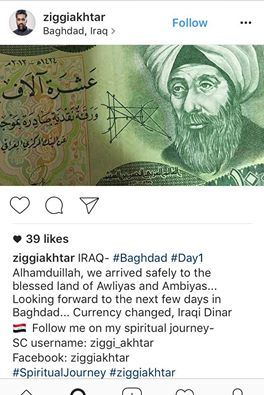

El Lewis

Went On Instagram Today And I Have A Instafriend On There and He’s Been Keeping In Touch With Me and This Is What He Posted On His Page Today.

BGG ~ Thanks El!!

Follow us on twitter @DinarUpdates !!

Don’t MISS – “DU NEWS TIME” w/MadDScout, 1Bobby and MORE!! – Dec. 15th 7:30pm EST – In DU CHAT!!

Don’t MISS – “DU NEWS TIME” w/MadDScout, 1Bobby and MORE!! – Dec. 15th 7:30pm EST – In DU CHAT!!

www.DinarUpdates.com – save as favorite

Islandg1211 (Dinar Guru) – NOTHING, NOTHING, NOTHING…THEN SOMETHING! Recently…the CBI came out and stated that they had tried to delete the three zeroes before in 2011, 2013, and 2015, but were delayed and plan on beginning the projects the first part of 2017…Three attempts that failed…hopefully, 2017 finally going through.

Read More: http://www.dinarupdates.com/observer/

Why Maliki insists that back? (OPINION)

Rahim more – I spoke in a previous article titled (Maliki returns) Published on 2016/9/25 http://rudaw.net/arabic/opinion/250920161 for enablers return of former Prime Minister Nuri al – Maliki issued the political scene in Iraq, and listed securities by maneuvering them ( of course he currently holds a position as close to the Honorary is the Vice President of the Republic, but it is clear that he lead roles much more than being one of the three vice honorary President of the Republic Fakhri is the other), and explained the pitfalls encountered the man to fulfill his dream to return again to the position of the ether on his heart it is the Prime Minister (mean nothing to the owners of any other positions in addition to being a Vice president of the Republic, is also the secretary general of the ruling Dawa party, and the president of the State of law bloc in the House of Representatives, the actual supervisor of the popular crowd, the whole does not charge as much to return as prime minister).

Now, al – Maliki has made progress on a trip back to the office, I want to highlight the stages completed so far to achieve the aspirations of , and I want to put hypothetical answers to the big question: Why Maliki insists that the prime minister is due?

– The footsteps of former Prime Minister aspirant to return strongly to the front of the scene, preliminary steps:

• managed first ( to take advantage of his influence growing to spend obedient to his wishes) to break the decision of Prime Minister Haider al – Abadi sacked vice president, a symbolic move and legal larger than a return to the assumption ceremonial post, he wanted to say that I exist and strongly and will not can not Abadi and other exclusionary of the scene.

• and then issue the popular crowd, which is another step on the road to al – Maliki , the return of the pyramid of power law, look to the tone of his speech mounting in recent days that the legitimate father of the crowd , a founder, has thus become the has a legal military arm bridleth by his opponents and employs election.

• start procedures for the enactment of the tribes is the first in Iraq after the abolition of the Republican clan Act of 1918 in 1959, and clearly visible over the hiring Maliki tribes in a long series to extend its influence over the state and society.

• did not stop Maliki ‘s efforts to get a third term after the general elections in 2014, only the market to him that Abadi presidency of the government is nothing to be only a transitional stage paving the way for his return, an imitation of the experience of Putin rotate positions in Russia, and has therefore been deposited as prime minister and deposit the Abadi until the next election in 2018.

• consolidation of its strong relationship with Iran Her final say in naming the prime minister in Iraq since 2003, and perhaps the famous Maliki ‘s speech at a conference (Islamic awakening) in Baghdad on October 22 / October 2016 in which the exciting sayings fired (coming, paper, coming Aahalb, coming, Yemen) in Tmah clear with the Iranian strategic project in the area, confirming once again presented his credentials as a carrier of the banner of Iran in Iraq and the region, the first and most important specifications Iranian acceptance of candidates for the post of Prime Minister of Iraq.

As for why Maliki insists on return to the office where he spent eight lean years, it is what can be seen through:

• exposure Maliki fierce and degrading attacks from his opponents within the political process and beyond since the overthrow of a project his third term, even exceeded it insults and verbal insults and various types of abuse, to attempts are continuing to be submitted to the trials on charges related to the fate of hundreds of those killed in the massacre Spyker or alienate Iraqi provinces for the benefit of a full Daesh terrorist organization or of corruption and waste of the Iraqi state funds and bankruptcy.

Not shield him stave Maliki all this and fortifies himself only the first position in the Iraqi state.

• the spirit of revenge which is a clear advantage in the man ‘s behavior, which believes that nothing Ahbaha but to return again to harass his opponents and his opponents , particularly a well – known unique in its ability to manufacture various files to overthrow the others, noticed his threats to protesters Basra , including call (Charge of the Knights) seconds, and even waving explicitly violent prosecution of those demonstrators.

• Do not remain in front of al – Maliki and other tasks not yet been completed as part of a regional project to address the re – demarcation of the countries of the region after the completion of an era Daesh in Iraq , US President – elect Donald Trump recognizes actually functions, there is no better than al – Maliki to perform such roles on behalf of the outside.

• The man lives (denial) Denial Case as he calls the US – known journalist Bob Woodward, a condition suffered owner of denial that lie the facts in front of him, al – Maliki denies responsibility for the occupation Daesh to one – third of Iraq ‘s territory, and killed thousands of Iraqis and the displacement of hundreds of other of them thousands, and denies responsibility for the dissipate and bankrupt the country ‘s wealth, and deny corruption discharged and richness and his family on the expense of public money, and deny use his influence to put pressure on the institutions are supposed to be independent such as the judiciary and the integrity Commission and the election commission, al – Maliki also deny fabricated charges of his opponents and the use of public money to buy off supporters to him.

(State of denial) This says a psychologist paid by the patient to reject everything except what he sees around him is true, regardless of the enormity of what has been committed.

Overall, quite clear that the balance Maliki stronger than Mnahiah whether the Sadrist movement or the civil power, as he walked forward towards the consolidation of his power , which is expected to be crowned by getting back on the prime minister, which was built in eight years of direct rule and two years of indirect rule gives him a chance larger than the other, unless it was with the US administration of President – elect another opinion, only the Americans are able to dispel Ahlam al – Maliki.

Iraqis were invariably silent and wretched on its mind, do not have -llasef Alhdid- in the foreseeable future at least, means the overall change in light is determined to al – Maliki and his ilk Format political process.

Maliki cut more than half of the nearly half coming back as prime minister, what are you doing?!

This article reflects the views of the author and does not have a relationship point of view Roudao Media Network.

Read More: http://www.dinarupdates.com/showthread.php?44563-Why-Maliki-insists-that-back-(Opinion-Piece)-12-13

______________________________________________________________

Kaperoni (Dinar Guru) – Article: “Is Iraq heading to float the dinar against the dollar?!” Quote: “…and these expectations (float Iraqi dinar) does not have any credibility at all and can not be done during the current year (despite the economic benefits), and the reasons for not float the currency back to the nature of the local economy being a rentier which means that he relies on oil exports…” This guy is right, they can’t float the dinar at this time. Until the laws are passed and the market economy is started, investors begin to come into Iraq.

(Please note the Mr White commentary along with the referenced article below…)

Read More: http://www.dinarupdates.com/observer/

______________________________________________________________

Be sure to join the Dinar Updates “private” FaceBook Group…

https://www.facebook.com/groups/571383766355188/

(go here and ask to join… then add some Dinar Friends!!)

______________________________________________________________

BGG (Dinar Guru) – “Ministerial council looking reinforcement provided by NATO to support Iraq contracts” NATO support… [They have come a long way in terms of professionalism and quality of individual…] They want “International acceptance” and support – this is exactly how they get it. …they are on the road to restoration. Let’s hope sooner than later. All indicator seem to point to something being “up”…

Read More: http://www.dinarupdates.com/observer/

______________________________________________________________

Is Iraq heading to float the dinar against the dollar?!

Books / D.basil Abbas Khudair … Dozens of articles published about the reasons for the low exchange rate of the dinar against the dollar prices in light of the Iraqi Central Bank to sell billions of dollars each year, some of which pointed to the need to make local and international about suspicions of corruption surrounding the operations of trading in dollars and that proved some of the existence of acts of money laundering and the smuggling of the country’s wealth investigations to third parties, and some of them to finance terrorism, and all that has been said on the subject went unheeded because the Central Bank of Iraq is going in the same direction to sell more dollars are far different from the prevailing market price, it is virtually the dollar, which sells bank is 1184 dinars or 1190 dinars, while the exchange rate (the shops) exceeded 1,300 dinars to the dollar, the prevailing market price in represents a departure from the Help currency auction where the central bank set the dollar exchange rate in local markets in 1200 dinars per dollar maximum is supposed to take action regarding the offenders, and the problem true is that the irregularities regarding prices by offices, companies and banks going on since the birth of the auction, which hundreds of billions commissioned since 2004 and until today without anyone except for some cases that do not fit with the large size of the disagreements accounting, these irregularities publicly held day and night markets are dollar visible and do not work secretly.

Books / D.basil Abbas Khudair … Dozens of articles published about the reasons for the low exchange rate of the dinar against the dollar prices in light of the Iraqi Central Bank to sell billions of dollars each year, some of which pointed to the need to make local and international about suspicions of corruption surrounding the operations of trading in dollars and that proved some of the existence of acts of money laundering and the smuggling of the country’s wealth investigations to third parties, and some of them to finance terrorism, and all that has been said on the subject went unheeded because the Central Bank of Iraq is going in the same direction to sell more dollars are far different from the prevailing market price, it is virtually the dollar, which sells bank is 1184 dinars or 1190 dinars, while the exchange rate (the shops) exceeded 1,300 dinars to the dollar, the prevailing market price in represents a departure from the Help currency auction where the central bank set the dollar exchange rate in local markets in 1200 dinars per dollar maximum is supposed to take action regarding the offenders, and the problem true is that the irregularities regarding prices by offices, companies and banks going on since the birth of the auction, which hundreds of billions commissioned since 2004 and until today without anyone except for some cases that do not fit with the large size of the disagreements accounting, these irregularities publicly held day and night markets are dollar visible and do not work secretly.

The decline of the Iraqi dinar exchange rate against the dollar is not a passing issue and it is a real tragedy should devote proper attention to her as it relates to people’s livelihood, especially the poor and low-income them. Most what we consume is imported from abroad, traders raise prices whenever the price of the dinar has fallen despite the imports are financed currency auction in the Iraqi Central Bank, and in practice, the dollarization prevailing in most of the transactions, despite the state refuses to dollarization because the local currency is the dinar, prices of airline Iraqi Airways tickets are identified and sold in dollars, as the various goods and services is calculated their prices in dollars and then be transferred to the the dollar, and this duplicity in dealing makes dollar demand high because local merchants need a dollar, and some citizens are forced to keep the dollar for the purpose of payment or reimbursement, the real problem is that the exchange rate we are not subject to supply and demand mechanisms, but for other reasons not related to the concepts and applications economic, Central sales of the dollar goes down, but the dinar exchange rate rises at a time when getting just the opposite, and suggests that exchange rates outside the Iraqi Central Bank’s control and the proof is that the main objective of the establishment of the currency auction is the stability of exchange rates to the purchasing capacity is not affected citizens fluctuating prices, the reality of the case (yesterday) indicates that the dinar exchange rate was 1320 dinars per dollar, and the problem that the seller buys the dollar low price and sell my high price of the dollar due to the instability of exchange rates, as is the case in some countries such as Jordan and Lebanon.

And that there are large differences between the selling price in the Central Bank (1190) and the price in the market (in 1320), a difference of 130 dinars mean that there are millions or billions of dinars every day from the pockets of citizens go out to go into the pockets of the gatekeepers in dollar terms, each dinars more than the exchange rates cause an increase in the prices of goods and services needed by the citizen, because more than 95% of the subsistence needs of the citizen to be imported from abroad and is covered by the central bank, which sells dollars to dealers for the purpose of importation, and are investigating Rlaken traders first from the sale of goods dollar rates prevailing in the market and the second is for profit trade capped the dollar, and at the same time, the citizens suffer a range of first losses from buying needs at high prices and the loss of the national currency by as they go for the sake of security exploits currency auction, who are supposed to bring the needs of the citizen exchange rates prevailing at the central bank and not prevailing in the local markets because they are buying the dollar Central and prices, official and not from markets Altdharbah prices, and missing part of the equation can be summed up by asking that: If the trader imports goods from abroad in dollars bought by the central bank and sell them to Iraqi traders in dollars. Where they come in Iraqi dinars, which buy its dollar currency auction ?? , And the related question is whether the import of Iraq as much as the dollar sold where the tax proceeds for the budget for these imports?! .

Some that believe the reason for decline of the dinar rate against the dollar is to reduce the central sales of the dollar, which is not true belief, because the CBI did not stop selling the dollar or selling prices change even when lower prices for a barrel of oil to $ 20, the dollar has lost sales reached yesterday ( Monday, 12/13/2016) increased by $ 154 million were sold by $ 148 million to 32 banks and $ 6 million to 10 corporate banking, noting that the Iraqi Central Bank sales of the dollar has reached $ 31 billion for the period from the beginning of this year up to yesterday, and that the quantities sold included the living and the dead because the Warka Bank Ahli (for example) that has stopped working since 2010 and closed its branch does not exercise any acts or at its headquarters located in Khilani Square enters the Iraqi Central Bank auction and buy up to $ 5 million a day, while banks and companies and offices banking that share a long dollar a day, they are the same that are repeated their names and its activities since 2004 and until today, all dollar sells off set by the CBI prices, the price reached yesterday more than 1,300 dinars per dollar, although the exact price should not be more than 1200 dinars per dollar by the central instructions, comes high prices of the dollar despite the current rise in global oil prices after Brent crude oil reached more than $ 50 a barrel and the oil Marketing company (SOMO) the implementation of futures contracts for oil for the month of next January 2017 prices close to 50 dollars .

There are those who ask, if the dollar sales going on and oil prices in the case of high why the dollar prices rise and fall of the dinar prices, even though we are duty all important aspect of this question in the emergence of (layer) controls the dollar but there is another cause and respect the belief by some that Iraq will resort because its reserves from the dollar’s decline to float its currency along the lines of what happened in Egypt and Syria, Vtaoam currency achieves many returns to Mdechri dollar having seen the Egyptian pound exchange rate decrease of more than 18 pounds against the dollar after it was nearly 6 pounds per dollar, and dropped the lira Syrian to 52 pounds against the dollar after it was five against the dollar, and these expectations (float Iraqi dinar) does not have any credibility at all and can not be done during the current year (despite the economic benefits), and the reasons for not float the currency back to the nature of the local economy being a rentier which means that he relies on oil exports, and that this is linked to monetary factors, including the large monetary mass of the size and other reasons we do not want to go into details now, and it is almost certain that the currency was floated far from the guidelines, which means that adjusting the exchange rate back to its tracks natural commensurate with the Iraqi Central Bank instructions, you need to impose real control on companies and banking offices, combined with punitive measures for offenders, with the need to expand and facilitate the conduct of the dollar outlets for citizens to meet their needs and that of their legitimate rights and not to make it a breeding ground for corruption and stockbrokers and connotations.

Almaalomah.info

Folks… Seriously, and I mean SERIOUSLY!!! This discussion by this economist is NOT about the eventual international exchange rate that the CBI will set for the IQD.

Instead, this is the ever evolving discussion about how best to control the value of the IQD “on the street”. Currently, the auctions are used for that purpose. it has been a failure.

Now, everybody has an opinion about how best to do it. However, the Governor of the CBI just last week told the world how it will be accomplished;

“He noted that the solution in Iraq lies in dollar demand reduction through structural correction of the Iraqi economy, and not through refraining from selling the dollar.”

Reducing the demand is giving value to the IQD so that all of those goods being bought with the USD is now bought with the IQD. Giving value comes from the CBI in advance, prior, before, all of these foreign investors. Not after!!!!

Giving value to the IQD will also give the Iraqi citizen “purchasing power AND reduce the demand for the USD.

Are laws needed? Yes, but without value to the IQD none of the private sector growth will ever occur.

We have always thought, because we were told by certain “self proclaimed experts”, that it was investors first followed by economic growth followed by a rise in the IQD.

Sorry!!! That is AXX Backwards. If the value in the IQD does not occur up front all of the above will not take place. The Iraqi citizens need purchasing power. Look at what Alak stated (above).

Mr White

______________________________________________________________

How some investors are taking the ‘long view’ of Iraq despite war

Iraq’s Oil Minister Jabar Ali al-Luaibi arrives at a hotel ahead of a meeting of OPEC oil ministers in Vienna, Austria, November 28, 2016.

Heinz-Peter Bader | Reuters

As Iraq’s government battles against terrorists, a few investors aren’t entirely deterred from seeing opportunities in the war-weary country, which has yet to ascend to formal emerging market status. Some are taking a “long view” that calibrates inherent risks against potential opportunities.

Iraq is gradually emerging from a brutal two-year economic downturn, coupled with a bloody conflict with ISIS conflict and still percolating civil strife that has wreaked havoc on its infrastructure and institutions. Last month, one investor told CNBC a full-fledged economic revival would take at least a decade to come to fruition.

Yet a 2105 State Department report noted Iraq’s “long term potential” for U.S. investors, largely based on its status as the world’s fifth largest repository of oil reserves and massive reconstruction and infrastructure development needs. “U.S. companies have opportunities to invest in security, energy, environment, construction, healthcare, agriculture, and infrastructure sectors,” the report said, noting Iraq’s voracious import demand needs.

Meanwhile, a few experts point to the oil rich country’s vast natural resources, and a youthful and growing population that provides it with the manpower to achieve stability—eventually. Along with a growth rate predicted to top 7 percent this year, Iraq’s underlying fundamentals make it a golden opportunity for investors brave enough to look beyond the sound and fury. So where might crafty investors place their faith—and funds?

“Two major themes will drive Iraq’s revival over the immediate and long term,” Ahmed Tabaqchali, chief investment officer of the Iraq Fund at Hong Kong-based Asia Frontier Capital told CNBC recently. The firm specializes in frontier and exotic investments.

Tabaqchali explained that rebuilding with the country’s booming population in mind should help drive growth.

“Wholesale infrastructure, careful rebuilding of the economy and reconstruction of ISIS-liberated areas are key,” he told CNBC in an interview from London, as will consumer consumption. “Iraq’s young population is hungry to catch up with the rest of the world after all the years of conflict,” he added.

As it stands, the stock market isn’t an ideal place to park money, Tabaqchali added, citing figures that show less than 20 percent of Iraq’s population holds an active bank account. Credit to the private sector currently stands at around 6.8 percent of 2014 growth, the fund manager said—which could benefit from the adoption of the “banking culture” that exists in more developed nations.

As the fog of war dissipates, telecommunications, mobile and Internet also stand to benefit, Tabaqchali added.

First, the war-torn country must guard its assets against terror and collateral damage, said Asha Mehta, lead portfolio manager of Acadian Asset Management, which holds around $70 billion under management) in developing market assets.

Currently, Iraq lacks a formal financial custodian that can hold funds. Without confidence that invested capital will be returned—and because Iraqi markets are generally illiquid—direct investment opportunities are limited for most investors.

However, Mehta points to recent positive developments that can ease investor concerns, including a financial lifeline from the International Monetary Fund, rising commodity prices and strong growth. Just this week, the IMF completed a review of a more than $5 billion tranche of funding that will immediately free up around $618 million.

It all creates what Mehta called “bottom up opportunities …[in] a volatile market.” The long-view requires not only patience, but a solid time horizon tied to real progress on the social front.

“Returns may be sentiment driven, so even thinly traded markets such as Iraq have the potential to boast strong returns. For example, progress on the military front in Iraq could be a catalyst for market level returns,” said Mehta.

http://www.cnbc.com/2016/12/11/how-some-investors-are-taking-the-long-view-of-iraq-despite-war.html

BGG ~ “…progress on the military front in Iraq could be a catalyst for market level returns,”…

I think they just told us what is about to happen.

______________________________________________________________

Iraq:

FIRST REVIEW OF THE THREE-YEAR STAND-BY ARRANGEMENT…AND STATEMENT BY THE EXECUTIVE DIRECTOR FOR IRAQ (Very long…)

______________________________________________________________

| CURRENCY | CODE | SELL | BUY |

| US dollar | USD | 1182.000 | 1180.000 |

| Euro | EUR | 1254.102 | 1253.475 |

| British pound | GBP | 1501.849 | 1501.098 |

| Canadian dollar | CAD | 900.915 | 900.464 |

| Swiss franc | CHF | 1166.371 | 1165.787 |

| Swedish krona | SEK | 129.045 | 128.980 |

| Norwegian krone | NOK | 140.130 | 140.060 |

| Danish krone | DKK | 168.631 | 168.546 |

| Japanese yen | JPY | 10.262 | 10.257 |

| Special Drawing Rights |

SDR | 1597.875 | 1597.076 |