The three presidencies meet tomorrow to resolve the budget dispute

The three presidencies meet tomorrow to resolve the budget dispute

(Baghdad: Al-Furat News) The three presidencies will hold, Thursday, an important meeting to resolve the dispute over the draft budget law for the year 2018.

A parliamentary source told the {Euphrates News} a copy of it that “the meeting will discuss the resolution of controversial issues, especially with regard to the budget of the Kurdistan region.”

“The meeting was held before the parliamentary session scheduled for tomorrow at 1 pm.”

He added that “the parliamentary finance committee reached final consensus in most of the demands of the blocks in the budget, except for the introduction of representatives of the Kurdish component.”

He drew the source to “insert the draft budget law on the agenda of the session of the parliament scheduled Saturday if the three presidencies resolved the dispute on it.”

It was scheduled to hold the House of Representatives, its regular on Wednesday, but the continuation of the dispute over the draft bill of the budget of 2018 caused the withdrawal of the law from the agenda and postpone the meeting to Thursday. End

Read More: alforatnews.com (Special Thanks to Tim Tarkington)

______________________________________________________________

Jubouri calls on all members of parliament to attend tomorrow’s session to vote on the budget

Baghdad: Speaker of the House of Representatives Salim al-Jubouri, on Wednesday, all members of the Council to attend the meeting on Thursday for the purpose of voting on the federal budget.

Baghdad: Speaker of the House of Representatives Salim al-Jubouri, on Wednesday, all members of the Council to attend the meeting on Thursday for the purpose of voting on the federal budget.

Jubouri said in a statement to his office received the agency {Euphrates News} a copy of it today that “delaying the adoption of the budget will cause a significant obstruction in the work of state institutions, especially in the current financial and economic situation, and will cause the growing market stagnation and slow trade, as well as political problems that Will result from this delay. ”

He stressed that “we all aspire to achieve more achievements and work to consolidate permanent stability through the preparation of economic and development conditions, and the need to look seriously and realistically to the conditions of citizens and work to improve the living conditions and service them, and the general budget is the most positive factors to achieve it.”

He called on the Speaker of the House of Representatives all members of the Council to “attend the session Thursday to vote on the budget and not to repeat the mistakes of the past.” is over

Article Credit: alforatnews.com

BGG ~ So – as near as I can tell, it looks like they intend to have a meeting of the 3 Presidencies, hammer out some final details and then get Parliament together right afterward to vote on it the same afternoon.

There is obviously some sense of urgency on their part. What is driving this surge? I do not know. It sounds like a long shot to me – but I’ll be glad if they pull it off.

______________________________________________________________

______________________________________________________________

The stability of the dollar exchange rate against the Iraqi dinar

(Independent) … The prices of the dollar exchange rate stabilized on the Stock Exchange and local markets on Tuesday (February 27, 2018).

Kifah Stock Exchange – Baghdad 122,000 dinars, the same price for Monday.

Selling and buying prices in banking shops:

Selling price of the dollar = 122,500 dinars.

The price of buying the dollar = 121.500 dinars.

Article Credit: mustaqila.com

BGG ~ This was from yesterday… I haven’t seen anything further on the OR/MR parity yet today (it’s what I’ll be watching close for a few days).

It’s is basically saying that after a few days of gains – the value of the Dinar has stabilized for now.

______________________________________________________________

Central Bank of Iraq Auctions $184,067,625 on 28 February 2018

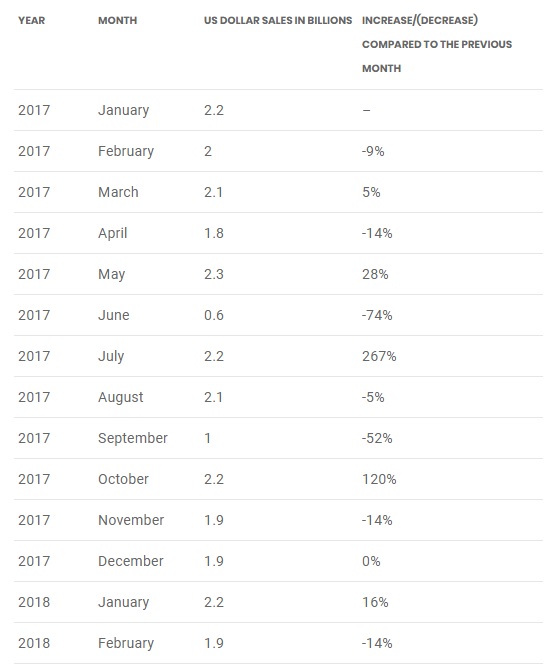

Baghdad (IraqiNews.com) The Central Bank of Iraq (CBI) currency auction on February 28 registered $184,067,625 in sales, a -3.08% volume decline from the US $189,921,893 sold by Iraqi Dinar, credit and transfer at the previous auction held on February 27.

The latest auction was attended by 45 banks and 9 remittance companies. The same institutions attended the auction held on February 28 compared to the previous auction.

Data for the February 28 auction was made public by CBI Announcement Number 3645.

Dollar sales in the in the period January 1, 2018 to February 28, 2018 saw an increase of -1% compared to the sales of US $6.1 billion in the same period in 2017. The total amount of US currency sold by CBI in the calendar year 2017 was US $15.7 billion.

An analysis of the monthly dollar sales by CBI since January 2016 reveals highly fluctuating volumes. During the period from January 2016 to February 2018, sales of US dollars averaged US $1.89 billion per month. Peak volumes were reached in May this year when sales touched US $2.3 billion.

Article Credit: http://www.dinarupdates.com/forumdisplay.php?5-Current-Iraq-NEWS

BGG ~ I will continue to highlight the regular auctions. After recently asking around about the reasons for the “tightening” of the supply of Dinar in the U.S… one of the main reasons I got was the fewer and fewer auctions. Wait – what?!? They are still having fairly robust auctions.

So, obviously, that’s not true… so what is it?

Another possibility is this MASSIVE financial embargo on Kurdistan, provided this was where currency was coming from.

I have also heard of a couple of major players talking about having money in – or being able to get money out of Kurdistan… all baloney. Kurdistan has been under very tight controls since snubbing the world diplomats with this sham vote pushed by Barzani.

Why was it a sham vote? Simple fact: you can’t just take what isn’t yours to take just because you vote on it.

Back to my previous rebuttal – anyone who actually had money in Kurdistan would have either gotten it out or is REALLY “up a creek”… likely just more B.S.

So…

1) Fewer auctions?

2) Tightening borders (fewer exports)?

3) More demand? I sincerely doubt it.

4) IMHO and most likely, the supply here in the U.S. from disgruntled sellers, which is likely where the bulk of the U.S. supply really comes from, and current interested buyers has finally reached a point of parity where the “supply – demand” scales are more evenly balanced.

Hence, the price goes up (Currently selling between $1100-$1200 per million)

______________________________________________________________

Nusseiri: The implementation of the strategy of the Central Bank contributed to the improvement of the dinar exchange rate against the dollar

Economy News _ Baghdad – The economic and banking adviser to the Association of Iraqi Private Banks Samir Nusairi, said that the central bank and the banking sector played a key role in overcoming the economic and financial crisis, and support the state treasury and methods and procedures and new instruments in the applications of monetary policy.

Economy News _ Baghdad – The economic and banking adviser to the Association of Iraqi Private Banks Samir Nusairi, said that the central bank and the banking sector played a key role in overcoming the economic and financial crisis, and support the state treasury and methods and procedures and new instruments in the applications of monetary policy.

Al-Nusairi said in an interview with “Economy News” that “the Central Bank has worked mainly on combating money laundering and financing of terrorism, strict adherence to international regulations, rules and standards, re-evaluation and classification of banks in light of their compliance with compliance regulations and determining the last beneficiary in the window of sale of foreign currency and work mechanisms New in the proactive control internally and externally led to higher value and purchasing power of the Iraqi dinar against the dollar exchange rate, “noting that” the most prominent reasons for the recovery of the Iraqi dinar is the plan and procedures of the Central Bank and cooperation with the banking sector and the commitment to Died and standards issued by the Central Bank. ”

“The Iraqi banking sector is the first major link in the economic circles of Iraq and occupies a fundamental and important aspect as the financial and investment sector, which is the main part of the financing and management of economies.”…

Read Full Text: http://www.dinarupdates.com/showthread.php?56381-The-implementation-of-the-strategy-of-the-CBI-contributed-to-the-Dinar-improvement

(Special Thanks to Vernell)

______________________________________________________________

Kaperoni (Dinar Guru) – …Banks don’t want to lose money. They want to know what the spread is from day to day. They want to know how much it’s going up and how much it’s going down and so on…this has always been an issue since I’ve been in this investment. The Central Bank had to reduce the spread…Shabibi actually did a wonderful job. He lowered the spread within the conditions set forth in their article IV consultations. He got it down to 1200 or so on the street and held it there for 10 months. In September of 2012 he announced he was going to begin currency reform so we assumed he was going to Article VIII at that point. Then of course PM Maliki at the time said No, we’re not ready. We don’t want this to occur…When Shabibi was out of the country for a conference Maliki put out a warrant for his arrest. Which in essence kept him out of the country and stopped the process in it’s tracks.

Read more: http://www.dinarupdates.com/observer/

______________________________________________________________

Kaperoni (Dinar Guru) – …IMF: “Although performance under the Stand-By Arrangement has been weak in some key areas, understandings on sufficient corrective actions have been reached to keep the program on track. Against this background, Directors encouraged resolute implementation of the authorities’ program including continued efforts toward fiscal consolidation, strengthening the financial sector, and implementing structural reforms to promote private sector activity and improve the business environment.” Very key…That is about as stern as I have ever seen from the IMF. I just think were in a good place finally. With the help of the UST and IMF it looks like they got a plan to reduce the spread. And with at 1220 now we are only 7 dinars away from 2%. So by end of week maybe. Can they hold it? Well I think there is to much riding on it to not to.

Read more: http://www.dinarupdates.com/observer/

______________________________________________________________

BGG Q & A:

Q: What is this 90 day 2 % everyone talking about has it started and does it mean we have to have 2 % for 90 days before a rv ?

A: If I recall correctly, the “IMF 2% rule” refers to the spread between the Official rate and Market rate of the currency on any given day.

The rule is, basically – they must maintain this 2% (or less) gap for at least 90 days prior to accepting IMF Article 8 general obligations (as a member country) and concurrently from then on. Now – would the IMF allow them some latitude on the 90 day entry point? Possibly.

However, the real issue everyone is stewing over is this…

Does this recent closing of the gap between the “Official rate” and “Market rate” forecast some coming change or is it much ado about nothing?

There are articles regularly touting the tightening of this gap… or the “Strengthening of the Dinar against the Dollar” or some other various titles along those same lines. Ask yourself why? Because they know what it means.

Whichever side of the fence you are on here, this tightening of the OR/MR gap is the single most visible, interesting and encouraging “data point” we’ve seen in a very, very long time.

Personally, as I have said many times, I don’t care if it is a fixed rate, a managed rate, a dirty float, a naked float or some weird combination. I DON’T CARE!!

My confidence in the future of Iraq is such that, I believe whichever it goes – in a reasonably short period of time, the value will wind up in the same place any way.

The key for me? Just get STARTED!!

Q: Doesn’t this mean it won’t move more than 2% after its revalued? What’s everyone’s concern? It’s that it can move from where it is no more than 2% which means nobody gets rich over night. It doesn’t even start until after they are an internationally traded currency. Much concern about nothing!!

A: That’s not at all what it means…

1) this refers the spread between the official rate and the market rate… NOT a 2% difference between today’s official rate and tomorrow’s official rate.

Further – the 2% rule doesn’t care if the rate is .10 per Dinar or $10 per Dinar… or if it fluctuates across that whole range for 90 days (just an illustration – not possible). What matters is if the “Official rate” of ‘X’ and the “Market rate” (which is the number it is sold at, publicly) have a reflective DIFFERENCE of 2% or less.

2) Internationally trading and value should (or could) happen at the same time.

(Stay tuned for more…)

______________________________________________________________

Kaperoni (Dinar Guru) – From the IMF last Sept… “25. The government will gradually remove remaining exchange restrictions and a multiple currency practice (MCP) with a view to eliminating exchange rate distortions.Such a move towards acceptance of the obligations under Article VIII of the IMF’s Articles of Agreement will send a positive signal to the investor community that Iraq is committed to maintain an exchange system that is free of MCPs and restrictions for current international transactions and thus facilitate creation of a favorable business climate.” So it’s coming. That should perpetuate a new exchange rate regime as well causing the dinar to rise. …I believe once it starts, it won’t take more than a year to rise to a value we are comfortable with.

Read more: http://www.dinarupdates.com/observer/

______________________________________________________________

Enorrste (Dinar Guru) – …Once the ball starts rolling it will proceed quickly to a value that we can all enjoy. The simple fact is that there are now a vast majority of factors in our favor versus the few left that seem to be holding this back. ISIS is decimated in Iraq; the banking structure is becoming more internationally connected; interest in investing has risen even if actual investment has not yet begun; the CBI has finally tackled the problem with the spread (this is really key); the CBI is officially on the record now for some time to move toward a floating currency; talk of ending the auctions has risen to the point that it will become a reality soon; the IMF is trustee over the CBI and is on record to move Iraq into the real world; etc. I will be surprised if we don’t see the float begin sometime this year.

Read more: http://www.dinarupdates.com/observer/

______________________________________________________________

Stability of the dollar in Iraq, but the lowest for weeks

[BAGHDAD] Foreign currency markets in Baghdad on Tuesday morning stabilized at the dollar’s exchange rate against the Iraqi dinar but are still at their lowest level in weeks.

The market price in the Kifah Stock Exchange in Baghdad was 1220 dinars per dollar, or 122 thousand dinars for one hundred dollars.

The prices of selling and buying dollars in banking companies were:

The selling price of one dollar 12250 dinars, or 122 thousand and 500 dinars, for one hundred dollars and the purchase price of the dollar is 1215 dinars, or 121 thousand and 500 dinars, for one hundred dollars.

Foreign Exchange Rates:

EUR World Price: 100 Euro = 123.21 USD The

World Price: 100 Bounds = 139.55

Turkish Lira. World Price: $ 100 = 378.45 Turkish Lira.

Article Credit: alliraqnews.com (Special Thanks to Vernell)

BGG ~ Oh wow!! Another move down!!

…”the 2% rule is calculated off the Official Rate plus CBI commissions (1182 + 8 dinar commissions X .02 = 23.8) which puts it at 1213 to $1″…

only 7 more Dinars to go…

P.S. Them getting into compliance with IMF guidelines may or may not be a big deal. However, if it is, then a 3 Dinar move in one day – leaving only 7 Dinars to go, is a GIGANTIC DEAL.

______________________________________________________________

Some interesting headlines…

The parliamentary pledge to approve the budget by a tripartite meeting and a repeat scenario

Baghdad agrees to raise the proportion of Kurdistan from the budget and Erbil is waiting

______________________________________________________________

Today, the dollar is falling against the Iraqi dinar

(Independent) .. The prices of the dollar exchange rate resumed the decline with the beginning of this week on the stock market and local markets on Saturday (24 February 2018).

Kifah Stock Exchange – Baghdad 122.250 dinars, while prices for Thursday 122,500 dinars.

Selling and buying prices in banking shops:

Selling price of the dollar = 122.750 dinars.

The price of buying the dollar = 121.750 dinars

Article Credit: mustaqila.com (Special Thanks to both Charles and Tim)

______________________________________________________________

Click this link to join the DU “private” FaceBook Group…

https://www.facebook.com/groups/571383766355188/

(go here and ask to join… then add some Dinar Friends!!)

______________________________________________________________

Post RV Checklist (it’s getting to be that time!! Listen up!!)

Dos and Don’ts of Windfall Wealth:

Treat it like a PowerBall win

– Tell no one, not even family. If you must talk, do so with one who is already in the know.

– Don’t run out & buy new “stuff”. People notice.

– Get an unpublished number and give it out very sparingly.

– Get a tax accountant you can trust to make sure the IRS is satisfied (Certified Opinion is something to look into) and pursue asset protection…

Read Complete List: http://www.dinarupdates.com/showthread.php?18519-The-Post-RV-Checklist-and-Flashback-documents&p=128477#post128477

______________________________________________________________