A campaign is launched in Iraq to dismiss the governor of the Central Bank

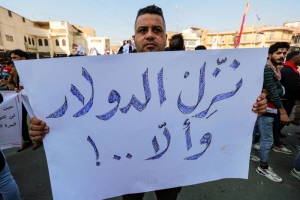

Baghdad – The removal of Ali Al-Alaq from his position as Governor of the Central Bank of Iraq has become a declared goal by forces that hold him responsible for failing to stop the rapid rise in the exchange rate of the US dollar, while doubts are swirling about the real motives of those forces, which some do not hesitate to accuse of trying to deepen the chaos of the financial sector in The country, in an effort to confuse government efforts to limit the bleeding of hard currency resulting from the smuggling of dollars towards Iran and Syria.

Baghdad – The removal of Ali Al-Alaq from his position as Governor of the Central Bank of Iraq has become a declared goal by forces that hold him responsible for failing to stop the rapid rise in the exchange rate of the US dollar, while doubts are swirling about the real motives of those forces, which some do not hesitate to accuse of trying to deepen the chaos of the financial sector in The country, in an effort to confuse government efforts to limit the bleeding of hard currency resulting from the smuggling of dollars towards Iran and Syria.

Parliamentary authorities launched a movement within the corridors of the House of Representatives to pressure Prime Minister Muhammad Shiaa Al-Sudani and push him to dismiss Al-Alaq.

Representative Adnan Al-Jabri accused Al-Alaq of failing to control the rise in the dollar exchange rate. Al-Jabri said in a statement reported by Iraqi news sites that there is complaint in political and popular circles about the decline of the dinar against the dollar, calling on the government to take measures against the governor of the central bank.

The MP, who describes himself as an independent, pointed out that “after assuming the position of governor of the Central Bank, Al-Alaq presented a plan to control the rise in the dollar exchange rate, but he failed in it and did not fulfill his promises to the Iraqi people.”

He also revealed that there were “deliberations within the House of Representatives to take measures against the governor, as he is directly responsible for the currency market.”

An oral question directed to the Sudanese included a direct criticism of the Governor of the Central Bank and accused him of mismanagement, describing that limiting the reason for the rise in the dollar exchange rate to currency smuggling was merely an American claim.

The banking system in Iraq is witnessing a state of chaos, manifested in the inability of the authorities to control the rise in the dollar exchange rate, which has cast a shadow over the commercial movement in the country and the economic cycle as a whole, raising fears of wasting a new opportunity to relaunch development provided by the rise in oil revenues.

For its budget, Iraq relies mainly on oil revenues transferred to it by the United States of America in dollars.

In recent months, the US government’s warnings to its Iraqi counterpart have increased that a large portion of the dollars it supplies end up being smuggled to Iran, which runs networks of financial manipulation inside Iraq with the help of political forces and armed militias affiliated with it there.

In order to limit this, the United States imposed sanctions last July on fourteen Iraqi banks, which the US Treasury accuses of being involved in dollar smuggling and money laundering.

Later, the US Assistant Secretary of the Treasury for Terrorist Financing and Financial Crimes, Elizabeth Rosenberg, met with the Prime Minister, the Governor of the Central Bank of Iraq, and representatives of private sector banks in Baghdad, and agreed with them on an action plan to improve the performance of the Iraqi financial sector in preventing fraud, sanctions evasion, terrorist financing, and other illegal activities. .

As part of its measures to control financial conditions, the Iraqi government decided to set an official exchange rate for the dollar not to exceed 1,350 dinars, hoping to stop the rise in the value of the American currency and reduce demand for it.

But the result was completely opposite, as the dollar continued its rapid rise until its value reached 1,630 dinars on Wednesday.

Iraqi authorities doubt that this is an automatic matter, pointing to the presence of coordinated manipulation operations by organized networks whose branches extend within some political forces and armed factions with the aim of sustaining chaos in the Iraqi financial sector, allowing them to continue obtaining the largest possible amount of dollars and smuggling them out of the country.

The same parties point out that manipulation of the dollar has become a lifeline for several parties, including armed militias linked to political forces that manage them and need huge sums of money to arm them and pay the salaries of their members and the consequent compensation for these members and their families in the event that they are injured or killed while performing the tasks they are assigned. .

From this standpoint, these parties consider that the campaign currently directed against the Governor of the Central Bank is part of efforts to sustain chaos in the Iraqi financial sector.

An Iraqi expert in financial affairs considered that what the Central Bank of Iraq has taken in its efforts to preserve the value of the local currency and protect it from the distortion of the dollar is consistent with what is usually taken by financial institutions in other countries.

He stressed that completing the procedures to make the financial authorities’ plan a success falls on the security authorities, who must dismantle currency manipulation and smuggling networks.

The expert added, “What makes it difficult to take effective legal measures against these networks and those behind them is their interference with political parties and armed factions, some of which may be actually participating in power.”

The intersection of dollar smuggling networks with political forces and armed militias makes it difficult for the Iraqi state to resist them

The confusion of the Iraqi banking system will not be without far-reaching consequences on the country’s economy, and thus on its development path and social situation.

It was stated in a report issued by the International Center for Development Studies, which is based in the British capital, London, that this system, instead of being a contributor to the development of the Iraqi economy, has turned into an obstacle to growth and attracting investments and has become an essential component of money smuggling and money laundering networks.

The report indicated the presence of a large number of banks owned by figures close to politicians, parties, and armed militias that contribute significantly to dollar smuggling and financing foreign trade operations with neighboring countries in exchange for receiving commissions and political support.

It was estimated that two-thirds of the Central Bank of Iraq’s sales through the currency selling window, which ranged at levels of $250 million per day, did not benefit the Iraqi market over the past two decades, which led to the country losing sums of money of no less than $400 billion.

Rawabetcenter.com