IMF figures expose the hidden truth

IMF figures reveal the truth: A privileged minority controls the lion’s share of Iraq’s budget.

IMF figures reveal the truth: A privileged minority controls the lion’s share of Iraq’s budget.

An Iraqi economist says that 20% of employees take 40% of the funds allocated for salaries, and that these go to the salaries of presidents and senior officials, both current and retired, while the salaries of all segments of the population are included in the remaining percentage of the budget, in its investment and operational aspects, attributing this to the International Monetary Fund.

Expert Duraid Al-Anzi adds in a media interview that all salaries are delayed except for the salaries of parliamentarians and the three presidencies, and the retirement salary of the presidents of the republic is not delayed, as are the retirement salaries of parliamentarians, and these expenses cannot be covered under any government, according to him.

So how does this happen? That is, millions of ordinary Iraqi employees and retirees have small salaries within the remaining 60% of the budget, of which 40% goes to salaries for a small number of officials and parliamentarians?

The point raised regarding the distribution of salaries of employees and officials in the Iraqi budget, as stated by the economic expert, quoting the International Monetary Fund, is a fundamental and worrying issue, and summarizes one of the structural problems in the management of public finances in Iraq; the difference here lies between the “numbers” and the “rates of salaries and allowances.”

The discrepancy observed between the small percentages of salaries for millions of ordinary employees and retirees and the enormous sums for a small number of officials and parliamentarians can be explained by an analysis of the expert’s statements and other relevant reports.

With reference to the salaries of senior officials (20%) for employees in Iraqi state departments, if we calculate their salaries and allowances, and they are the category associated with the three presidencies for the year 2024, for example, with a budget of $155 billion, it becomes clear to us the huge size of the large expenditure on those salaries, meaning that 40 percent amounts to $62 billion, of the size of the budget that was approved by the House of Representatives within the three-year budget.

Because of the enormity of the figures, some observers say there may be confusion or discrepancies in the reported figures, referring to what the research results show: that a small group of employees controls a huge amount.

But experts say that this huge amount (for 20% of officials, amounting to $62 billion of the budget) for a small group is due to the fact that the exorbitant salaries and allowances of senior officials and special grades (presidents, ministers, parliamentarians, undersecretaries, directors-general), advisors, and those of their predecessors among retired officials, are very high, and include huge financial allowances, bonuses, and very generous retirement rewards.

The number of deputy ministers, directors general, those in similar positions, and advisors is very large in Iraq compared to other countries, which increases the amount of money allocated to this category.

The latest economic reports and analyses of the Iraqi three-year budget (2023-2025) show the structural challenge related to the mass of salaries and allowances, which explains the disparity in spending ratios on employees and officials.

Salaries and allowances (including the salaries of Kurdistan Region employees) represent about 54% of the total planned federal budget.

According to some figures, this percentage increases, as estimates indicate that total salaries constitute between 65% and 67% of the state’s total actual spending. However, the salaries of employees in the Kurdistan Region, for example, are usually cut, and the distribution of their salaries and the salaries of other categories is irregular, while the salaries of officials continue as usual.

That percentage goes to millions of people, as the huge numbers of employees (who constitute the largest percentage of state employees) consume this percentage of the budget, even though their individual salaries may be modest compared to the salaries of the higher ranks.

Economic analysis focuses on the point that the salaries of millions of ordinary employees (despite their low individual salaries) constitute a large financial mass due to their large numbers.

The salaries and allowances of a small number of senior officials also constitute a huge financial bloc due to the astronomical rise in their individual salaries and retirement benefits.

But it is inequality that raises controversy regarding fairness in the distribution of wealth and the management of public funds, and is often cited as an example of the depletion of operating expenses and the concentration of spending on salaries and senior positions at the expense of development projects and services.

The financial percentages mentioned by expert Duraid Al-Anzi (40% for officials and parliamentarians) reveal a severe structural imbalance in the wage system, even if these percentages represent previous estimates or figures.

Officials and parliamentarians (a small number of the population) control 40% of the budget (or a large portion of salaries). This includes exorbitant salary and retirement benefits, and the salaries, allowances, and privileges of special grades (the three presidencies, ministers, parliamentarians, and undersecretaries), which are exceptionally high. The salary of one individual in this category is equivalent to the salary of tens or hundreds of ordinary employees, allowing a limited number of individuals to consume a very large share of the budget.

Ordinary employees (millions of people) have their share of what remains (and even if we assume that it is the largest part of the payroll at 60%), the explanation is that ordinary employees consume a large share due to numerical inflation (job redundancy), while officials consume a large share due to inflation in the individual value of salary and allowances (fictitious salaries).

This also explains expert Al-Anzi’s comment that “the salaries of parliamentarians and the three presidencies” are not delayed, because they represent financial obligations of the highest priority and are authorized to the highest allocations by decisions made by officials for themselves.

Shafaq.com

Cases of online financial fraud are on the rise in the country, with citizens being targeted by fake calls and links that trick them into transferring their money to fraudulent accounts. This is what happened to Ayman, an employee at a private company, who lost 1.6 million dinars in minutes. Money exchange office owners in Baghdad confirmed that a lack of security awareness and citizens’ impatience make them easy prey for fraudsters who quickly transfer funds to multiple accounts. Dr. Ammar Al-Ithawi, a professor of cybersecurity at Al-Nahrain University, explained that these crimes rely more on psychological manipulation than technical vulnerabilities, noting that fraudsters use fake links or impersonate government officials to convince victims to transfer money.

Cases of online financial fraud are on the rise in the country, with citizens being targeted by fake calls and links that trick them into transferring their money to fraudulent accounts. This is what happened to Ayman, an employee at a private company, who lost 1.6 million dinars in minutes. Money exchange office owners in Baghdad confirmed that a lack of security awareness and citizens’ impatience make them easy prey for fraudsters who quickly transfer funds to multiple accounts. Dr. Ammar Al-Ithawi, a professor of cybersecurity at Al-Nahrain University, explained that these crimes rely more on psychological manipulation than technical vulnerabilities, noting that fraudsters use fake links or impersonate government officials to convince victims to transfer money.

Cryptocurrencies saw a sharp decline on Monday, reviving a widespread sell-off that appeared to have subsided in previous days.

Cryptocurrencies saw a sharp decline on Monday, reviving a widespread sell-off that appeared to have subsided in previous days. U.S. Deputy Assistant Secretary of State for Resource Management Michael Regas arrived in the Iraqi capital on a visit aimed at strengthening the partnership between Baghdad and Washington and supporting joint efforts to promote sovereignty, stability and prosperity in the country.

U.S. Deputy Assistant Secretary of State for Resource Management Michael Regas arrived in the Iraqi capital on a visit aimed at strengthening the partnership between Baghdad and Washington and supporting joint efforts to promote sovereignty, stability and prosperity in the country. IMF figures reveal the truth: A privileged minority controls the lion’s share of Iraq’s budget.

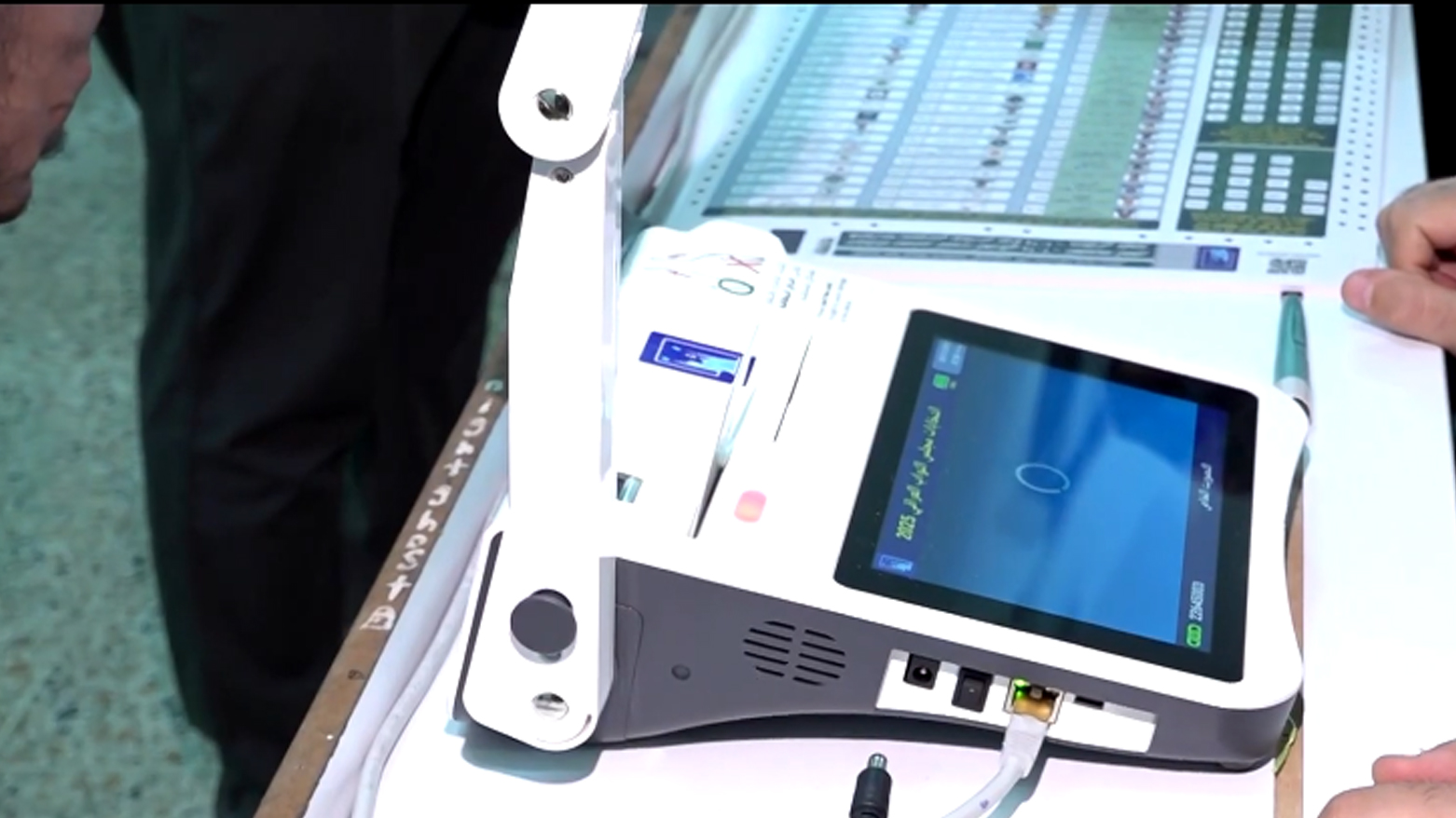

IMF figures reveal the truth: A privileged minority controls the lion’s share of Iraq’s budget. The Independent High Electoral Commission announced on Monday that it had completed all procedures for appeals against the election results and sent them to the judicial body. It also set a date for sending the results to the Federal Court. The head of the commission’s media team, Imad Jamil, stated in a statement to the official agency that “sending the complete election results to the Federal Court for ratification will take place after the judicial body has finished considering all the appeals.”

The Independent High Electoral Commission announced on Monday that it had completed all procedures for appeals against the election results and sent them to the judicial body. It also set a date for sending the results to the Federal Court. The head of the commission’s media team, Imad Jamil, stated in a statement to the official agency that “sending the complete election results to the Federal Court for ratification will take place after the judicial body has finished considering all the appeals.” A leader in the Al-Azm Alliance suggested on Sunday that the alliance’s leader, Muthanna al-Samarrai, is the most likely candidate to obtain the position of Speaker of the next House of Representatives, ruling out the return of former Speaker Mohammed al-Halbousi for several reasons.

A leader in the Al-Azm Alliance suggested on Sunday that the alliance’s leader, Muthanna al-Samarrai, is the most likely candidate to obtain the position of Speaker of the next House of Representatives, ruling out the return of former Speaker Mohammed al-Halbousi for several reasons. The Ministry of Electricity in the Kurdistan Regional Government announced on Sunday that the electricity supply has returned to normal, including to the “Ronaki” project, in all cities of the region.

The Ministry of Electricity in the Kurdistan Regional Government announced on Sunday that the electricity supply has returned to normal, including to the “Ronaki” project, in all cities of the region. The Central Bank of Iraq identified three solutions to address the country’s debt problem. While noting that a large part of the internal debt could be addressed through joint understandings, it stressed the need to diversify non-oil revenues and increase investments, asserting that these approaches would transform the economy from a rentier economy to a diversified and productive one.

The Central Bank of Iraq identified three solutions to address the country’s debt problem. While noting that a large part of the internal debt could be addressed through joint understandings, it stressed the need to diversify non-oil revenues and increase investments, asserting that these approaches would transform the economy from a rentier economy to a diversified and productive one. Al-Rasheed Bank announced today, Monday, the relaunch of its electronic loan service through the credit card with a maximum limit of 15 million dinars.

Al-Rasheed Bank announced today, Monday, the relaunch of its electronic loan service through the credit card with a maximum limit of 15 million dinars.